What is Corporate Tax Rate in Malaysia. An effective petroleum income tax rate of 25.

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

10 tax rate for up to 10 years for.

. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person. Mar 10 2022 In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits. Update Company Information.

Data published Yearly by. From 875 to 203 depending upon the location of the business establishment. Corporate income taxsolidarity surcharge.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Corporate tax rates for companies resident in Malaysia is 24. It shows an inverted U-shape relationship between the corporate tax rate and corporate tax revenue and reveals that the optimal tax rate is 255156 per cent.

Petroleum income tax. Tax Rate of Company. The maximum rate was 30 and minimum was 24.

The corporate tax rate is 25. Ghana Last reviewed 18 July 2022 25. For the assessment year 2016-2017 it stood at 19 the corporate tax rate in 2018 dropped to 18 in Malaysia and the government has announced a further reduction to 17 for.

24 Tax on Royalties. Jurisdiction 2014 2015 2016 2017 2018. The proposed sales tax will be 5 and 10 or a specific rate for petroleum.

Rate the standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. 10 Tax on technical fee installation fee management service fees 10 Tax on interest 15 Tax on. Albania 15 15 15 15 15.

The new Sales tax will be levied on taxable goods that are imported into or manufactured in Malaysia. Corporate Tax Rates 2014-2018 International Tax. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of.

Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. 0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia. Not only are the rates 2 lower for those who has a.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Corporate Tax Rates 2014-2018. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at. Resident companies with a paid up capital of MYR 25 million and below as defined at the beginning of the basis period for a Year of Assessment YA are. Companies incorporated in malaysia with paid-up capital of myr 25 million or.

10 Tax on rental of moveable goods. Malaysia was ranked 12 out of 190.

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Department Of Statistics Malaysia Official Portal

Finland Is A Northern European Nation Bordering Sweden Norway And Russia Its Capital Helsinki Occupies A Peninsula And Surrou Finland Mixed Economy Baltic Sea

Cukai Pendapatan How To File Income Tax In Malaysia

Corporation Tax Europe 2021 Statista

Gst Vs Sst In Malaysia Mypf My

Department Of Statistics Malaysia Official Portal

Gst Vs Sst In Malaysia Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

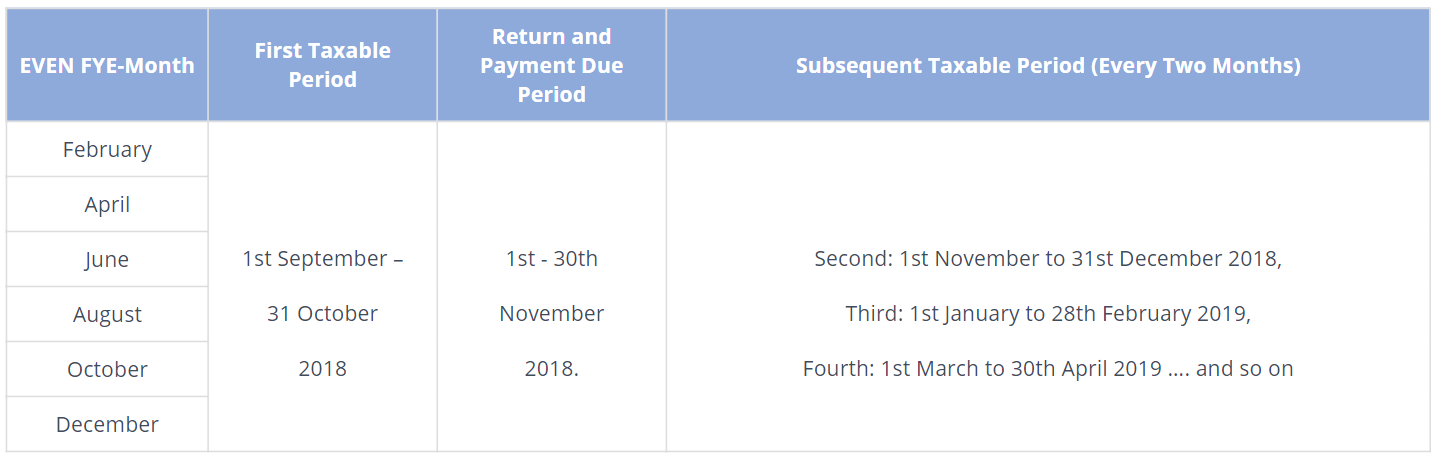

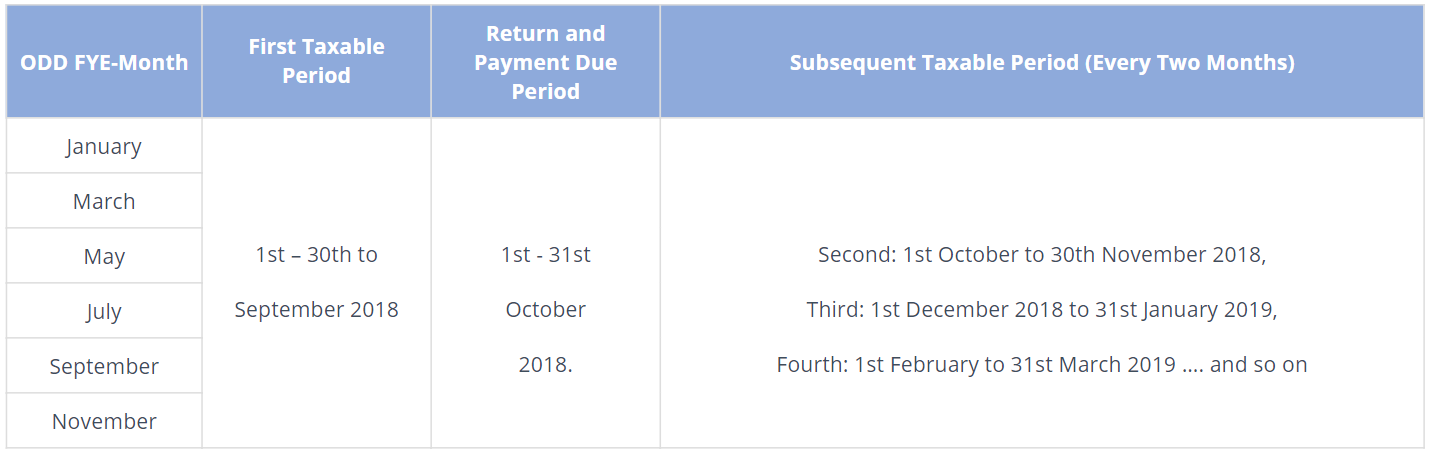

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Malaysia 2018 Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Tax Revenue 1980 2022 Ceic Data

Gst In Malaysia Will It Return After Being Abolished In 2018

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018